If you’ve been thinking about replacing your windows or upgrading your exterior doors, here’s some good news: the federal tax credit for energy efficient windows and doors is still available in 2025. The catch? This program is ending soon and it is not likely to be extended.

Let’s break down how it works, what qualifies, and why it makes sense to act now before the deadline arrives.

A Quick Background on the Tax Credit

This credit comes from the Inflation Reduction Act of 2022, which expanded and extended several home energy efficiency incentives. Before that, there were smaller, short-term credits for windows and doors, but they came and went.

The current version—the Energy Efficient Home Improvement Credit—has been running for projects in 2023, 2024, and 2025. After that, the window (pun intended) closes.

Who Qualifies for the Window & Door Tax Credit?

- Primary residences only – The home has to be your primary residence in the U.S.

- Existing homes only – New construction doesn’t qualify. This is strictly for upgrades.

- Owner-occupied – Renters generally can’t claim the credit, but landlords who live in part of the property might.

- All housing types – Single-family homes, townhouses, condos, and manufactured homes can qualify if they meet the above rules.

So if you own your home and you’re replacing old windows or exterior doors, you’re likely eligible.

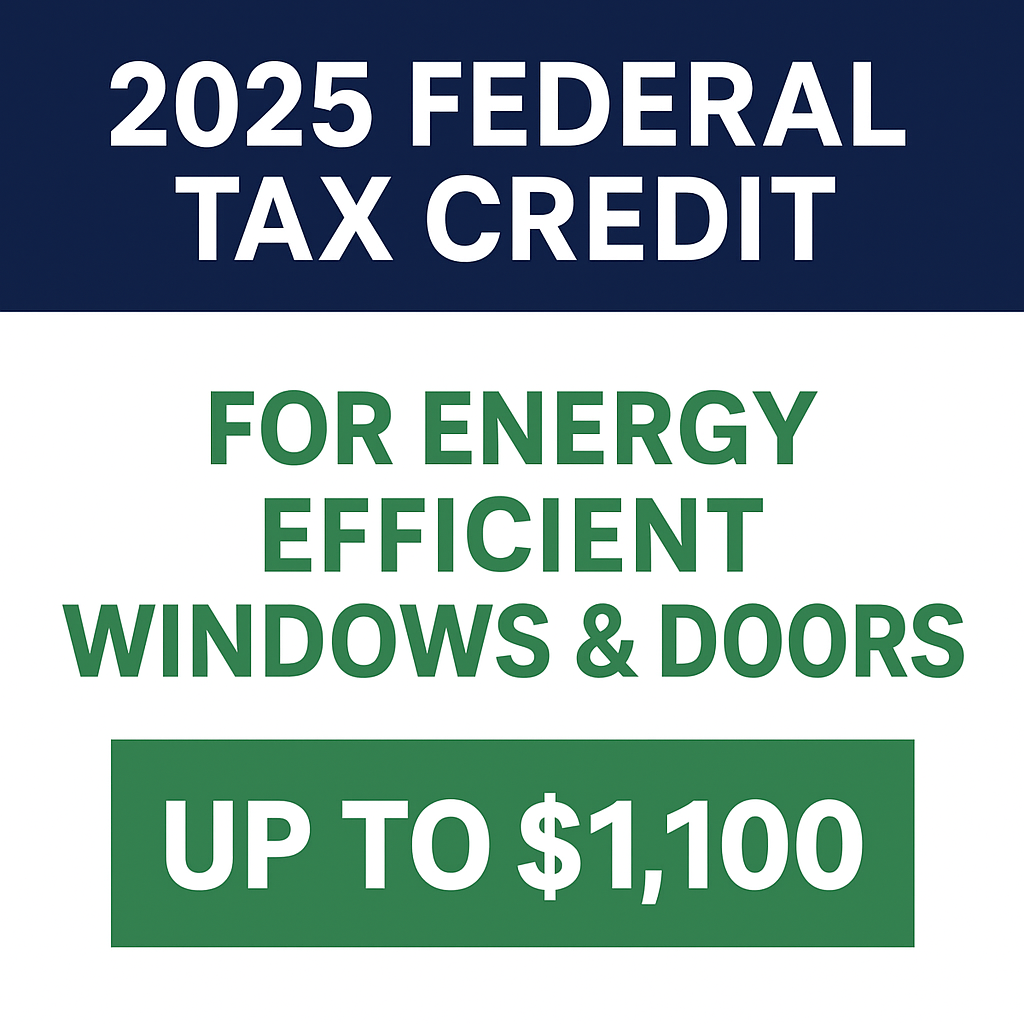

How Much Can You Save in 2025?

Here’s what the IRS allows for windows and doors:

- Windows and skylights: 30% of the cost, up to $600 maximum per year

- Exterior doors: 30% of the cost, up to $250 per door, $500 maximum total

- Annual total cap: $1,200 for all qualifying improvements combined (except certain HVAC or heat pump projects, which fall under a separate $2,000 cap)

Example Scenarios:

- Replace 4 windows for $2,000 → You’d save $600 (hit the cap).

- Replace 1 exterior door for $1,000 → You’d save $250.

- Replace 8 windows ($5,000) and 2 doors ($2,000) → You’d max out at $1,100 back.

Not life-changing money, but it’s real savings for work you might be planning anyway.

What Qualifies as “Energy Efficient”?

Not every product makes the cut. To qualify:

- ENERGY STAR certified: Windows need to meet ENERGY STAR MOST EFFICIENT Version 7.0 performance criteria for your climate zone. (See the official ENERGY STAR product requirements here.)

- U-Factor & SHGC requirements: These numbers measure heat transfer and solar gain. Lower numbers generally mean better efficiency.

- Manufacturer certification: Your window company should provide documentation showing compliance.

- QMID requirement: Starting in 2025, you’ll also need the Qualified Manufacturer Identification Number (QMID) for your tax return.

👉 Pro tip: Always ask your window company for the Manufacturer’s Certification Statement. That’s what proves your product qualifies.

For help picking the right model, check out replacement window reviews.

What’s Not Covered

- Labor costs – Only the cost of the windows and doors themselves.

- New builds or additions – Credit is for improvements, not new construction.

- DIY installs – You can claim the credit if you install the windows yourself, but the savings only apply to the cost of the product, not your time or tools.

How to Claim the Credit

When you file your 2025 taxes (in early 2026):

- Save all receipts, invoices, and manufacturer certification statements.

- Make sure the paperwork lists the ENERGY STAR certification and QMID.

- Fill out IRS Form 5695 (Residential Energy Credits).

- Report the credit on your Form 1040.

👉 You can find IRS Form 5695 and official instructions here on the IRS website.

Tax software or your preparer will guide you through the process. It’s not difficult, but documentation is key.

Common Questions People Ask About This Tax Credit for Efficient Windows

Do all ENERGY STAR windows qualify for the tax credit?

No. They must meet the specific 2025 ENERGY STAR MOST EFFICIENT criteria for your climate zone.

Can I claim the tax credit every year?

Yes. The credit resets annually through 2025. If you replaced some windows in 2024 and more in 2025, you can claim both.

Does installation count toward the credit?

No. Only the product cost qualifies, not labor.

Can I claim the credit if I replace my windows myself?

Yes. As long as the products qualify and you have the manufacturer documentation, DIY installation is allowed.

Other Eligible Home Improvements in 2025

Windows and doors aren’t the only upgrades covered. The Energy Efficient Home Improvement Credit also applies to:

- Insulation

- Exterior siding (if it improves efficiency)

- Heat pumps

- High-efficiency HVAC systems

- Water heaters

- Certain electrical panel upgrades

If you’re planning multiple projects, you could stack your savings within the annual $1,200 cap.

Why Energy Efficiency Pays Off Beyond the Tax Credit

The tax credit is a nice perk, but the real value comes from:

- Lower utility bills – Energy efficient windows reduce heating and cooling costs.

- More comfortable living – Fewer drafts and more consistent indoor temps.

- Increased home value – Buyers like homes with updated windows and low utility costs.

- Noise reduction – New windows can make your home much quieter inside.

For more details on the long-term benefits, learn how efficient windows reduce energy use at Energy.gov.

If you’ve been putting off a project, think of the credit as icing on the cake.

Why You Shouldn’t Wait

- The credit ends December 31, 2025 and is not likely to be extended.

- Contractors get busy. Don’t wait until fall, when installers are booked solid.

- Energy bills won’t wait. Every season you delay is another season of higher heating or cooling costs.

Choosing the best window installation company is just as important as the windows themselves, so give yourself time to find the right partner.

Final Thoughts

Replacing windows and doors is one of the smartest investments you can make in your home. With the federal tax credit still available in 2025, you have a great opportunity to save money now and for years to come.

But remember: the deadline is firm this tax credit expires December 31, 2025. Don’t wait until it’s too late.

👉 If you’re ready to get started, check out our guide on how much windows should cost or jump right into our listing of the best window companies all over the country.