The federal tax credit for replacement windows and doors is back! But, the requirements changed substantially in 2023, the potential benefit has gotten better and the whole thing is a little more complicated.

Many window salesmen don’t understand these programs so it’s important to make sure have the real information. We’ll get to the bottom of it right here.

Topics we’ll cover are:

- Changes to federal tax credits for energy efficient windows

- Requirements for tax credit for energy efficient doors

- Tax benefit for purchasing energy efficient windows and doors

- Cost increase for windows that qualify for the tax credits

Changes to federal tax credit for energy efficient windows and doors

Effective Jan 1, 2023 the requirements for tax credits for installing new efficient windows and doors have changed. The requirements are a more strict, meaning more efficient windows are required to get the tax credit.

In the past the windows just needed to meet the Energy Star criteria, but now the windows need to meet the Energy Star “Most Efficient” criteria which are substantially different.

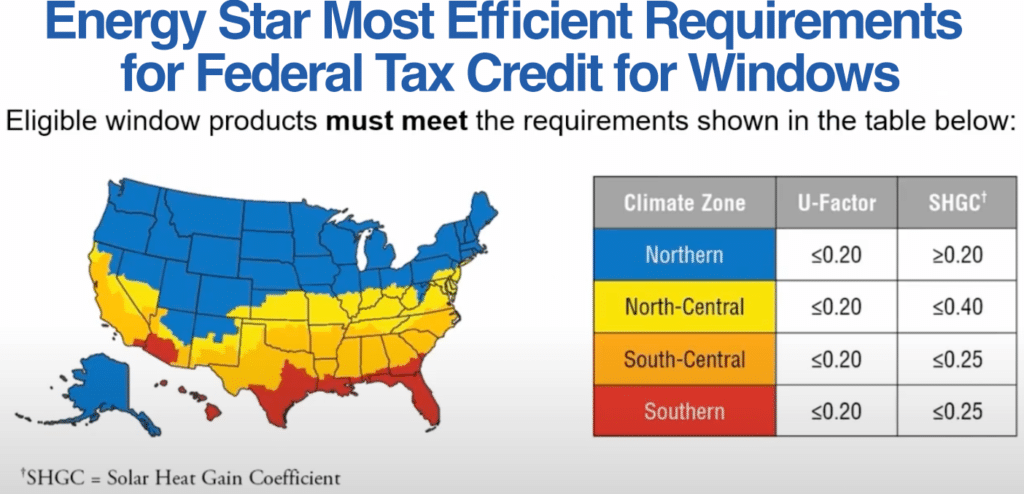

As you can see in the graphic above, the Energy Star most efficient criteria are different in the different climate zones. This makes sense because someone in Arizona has different efficiency needs than someone in Maine.

In all areas of the country windows need a U-Factor of 0.20 or less to qualify. For most windows this means they’ll need to have triple pane glass. Even with triple pane glass many products still won’t qualify. They’ll likely need other upgrades as well.

The other criteria is Solar Heat Gain Coefficient or SHGC. That number needs to be at or below 0.20 in the Northern climate zone, 0.40 in the North-Central, 0.25 in the South-Central and Southern regions.

If you’re looking at new windows that meet both of those criteria then you’ll qualify for the new federal tax credit. You can find details about how much money you can save on your taxes below.

Tax credit requirements for doors are quite a bit different

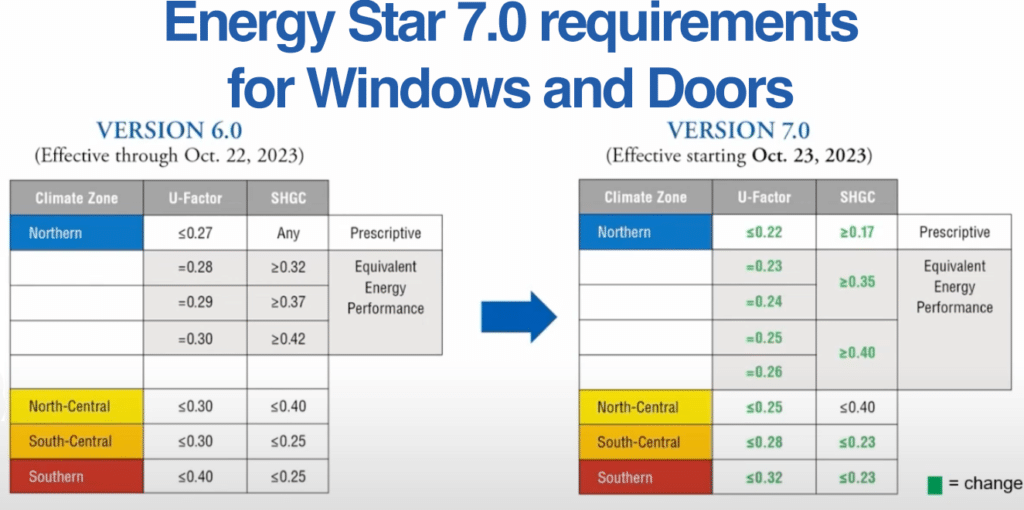

Doors, including sliding patio doors, only need to meet the Energy Star 7.0 criteria as of October 23, 2023. Doors do not need to meet the Energy Star Most Efficient levels in order to qualify for tax credits.

Does the terminology seem a little confusing? It’s a typical government program, but it’s easy enough to figure out.

Doors only need to meet the Energy Star criteria, but effective October 23, 2023 those requirements are changing and getting a little harder to meet. Find more info on tax credits for doors from the Energy Star website here.

In the graphic above you can see the difference between the old Energy Star 6.0 criteria and the new Energy Star 7.0 criteria for doors. There are a few ways to meet this criteria in the Northern climate zone. The other zones are a little more straightforward.

What is the tax benefit for installing energy efficient windows and doors?

What do you get back from Uncle Sam when you buy energy efficient windows and doors? If you purchase qualifying products you’ll be eligible for federal tax credits for 30% of the cost of the new windows and doors with a $600 annual max for windows and a $500 annual max for doors.

As an example, let’s look at someone who bought 10 windows and a sliding patio door for $12,000. You’ll need to get an itemized invoice from your window company that will break out the cost of the door from the windows and separate the labor.

Let’s say the windows were $6,000, the door was $2,000 and the installation was $4,000.

This person would be eligible for 30% of the cost of the windows ($6000 x 0.30 = $1,800). The max would limit the tax credit to $600 for the windows. The door would be eligible too ($2,000 x 0.30 = $600). They’d be limited to $500 for the door so this project would max out the tax credit and the person in our example would save $1,100 on their taxes that year.

This is a tax credit not a deduction so it’s real savings. Of course you should contact your tax professional with any questions, but it’s a relatively simple program.

It’s important to note that the max is annual meaning you could buy some windows this year, more windows next year and you can get the $600 for both years. I imagine some people will spread out projects to maximize tax credits, but many will probably just max it out one year and be done with it.

What is the cost of windows that qualify for tax credits?

The criteria windows and doors need to meet to qualify for tax credits has gotten more stringent. The cost has also gone up. You’ll need to order a more efficient glass package in order to qualify. The cost of that package will likely exceed the tax credit that you’ll receive.

That means you’ll pay more for the upgrade than you’ll get back. That’s not ideal, but it does offset the cost of getting a more efficient result.

In the example above the person bought 10 windows and 1 sliding door and qualified for $1,100 in tax credits. The cost of that upgrade compared to a more common efficiency package is likely to be in the range of $2,000.

In that case you’d be paying $2,000 in order to get a tax credit of $1,100. The net result is you paid $900 more and got windows that are much more efficient.

So, you’re not going to get new windows for free as a result of these tax credits, but it does offset the increased cost that comes with an efficiency upgrade.

That efficiency upgrade will make your home more comfortable and lower your utility costs for decades so it’s definitely something to consider. Especially with Uncle Sam paying part of the bill.

What else to know about window and door tax credits?

It’s important to note that you’re only eligible for these tax credits if the windows and doors are installed in your primary home. Rental houses don’t count.

You don’t need a professional to install the windows. You could install them yourself. However, it’s unlikely you’ll find windows efficient enough to qualify on the shelf at Home Depot. It takes higher end window to qualify. Products like that are typically sold through dealers or window companies.

Some manufacturers likely won’t have products that can meet these standards. The requirements are pretty strict. Some will also likely only have very expensive ways to qualify. This is because some companies will need to use krypton gas between the panes and that’s an expensive solution.

If you’re considering ordering windows it’s worthwhile to understand the cost difference involved in the upgrade that would qualify so you can make an informed decision.

If you’re looking for a window company you can find our recommendations for local window companies all over the country right here.

Must Read Content:

Find the best window company in your town

Replacement window reviews by manufacturer

Quote & order windows by email with no pushy salesman

This might be the future of replacement windows!